All the best recent cryptocurrency news, one single place!

XRP Price Reclaims $0.50 and Indicators Suggest Fresh Surge To $0.70

XRP price is recovering higher above the $0.500 resistance. The price is signaling a positive bias and might rally above the $0.580 and $0.600 levels. XRP is attempting a recovery wave above the $0.50 zone. The price is now trading above $0.5150 and the 100 simple moving average (4 hours). There was a break above a key bearish trend line with resistance at $0.5220 on the 4-hour chart of the XRP/USD pair (data source from Kraken). The pair could gain bullish momentum if there is a close above the $0.580 resistance. XRP Price Aims Higher After a sharp decline, XRP price found support near the $0.3880 zone. It formed a base and started a fresh increase above the $0.450 resistance, like Bitcoin and Ethereum. The bulls were able to push the price above the $0.50 resistance. The price climbed above the 50% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low. Besides, there was a break above a key bearish trend line with resistance at $0.5220 on the 4-hour chart of the XRP/USD pair. The price is now trading above $0.5150 and the 100 simple moving average (4 hours). Immediate resistance is near the $0.5650 level. The next key resistance is near $0.5820 or the 76.4% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low. Source: XRPUSD on TradingView.com A close above the $0.5820 resistance zone could spark a strong increase. The next key resistance is near $0.620. If the bulls remain in action above the $0.620 resistance level, there could be a rally toward the $0.680 resistance. Any more gains might send the price toward the $0.700 resistance. Another Drop? If XRP fails to clear the $0.5820 resistance zone, it could start another decline. Initial support on the downside is near the $0.540 level. The next major support is at $0.5150. If there is a downside break and a close below the $0.5150 level, the price might accelerate lower. In the stated case, the price could retest the $0.4650 support zone. Technical Indicators 4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bullish zone. 4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level. Major Support Levels – $0.540, $0.5150, and $0.4650. Major Resistance Levels – $0.5650, $0.5820, and $0.6200.

Ethereum Price Holds Support – Why ETH Could Soon Rally 5%

Ethereum price is holding gains above the $3,120 resistance zone. ETH could soon rally if it clears the $3,280 resistance zone. Ethereum extended its increase above the $3,220 resistance zone. The price is trading above $3,165 and the 100-hourly Simple Moving Average. There is a key bullish trend line forming with support at $3,170 on the hourly chart of ETH/USD (data feed via Kraken). The pair could continue to move up if it clears the $3,280 resistance zone. Ethereum Price Aims Higher Ethereum price remained in a positive zone above the $3,000 level, like Bitcoin. ETH extended its increase above the $3,150 and $3,165 resistance levels. It even spiked above the $3,250 resistance. It traded to a new weekly high at $3,263 and recently corrected lower. There was a minor decline below the $3,220 level. Ether dipped below the 50% Fib retracement level of the recent wave from the $3,154 swing low to the $3,263 high. However, the bulls were active above the $3,200 level. The 61.8% Fib retracement level of the recent wave from the $3,154 swing low to the $3,263 high acted as a support. Ethereum is now trading above $3,200 and the 100-hourly Simple Moving Average. There is also a key bullish trend line forming with support at $3,170 on the hourly chart of ETH/USD. Immediate resistance is near the $3,250 level. The first major resistance is near the $3,280 level. Source: ETHUSD on TradingView.com The next key resistance sits at $3,350, above which the price might gain traction and rise toward the $3,500 level. A close above the $3,500 resistance could send the price toward the $3,550 resistance. If there is a move above the $3,550 resistance, Ethereum could even test the $3,750 resistance. Any more gains could send Ether toward the $3,880 resistance zone in the coming days. Another Drop In ETH? If Ethereum fails to clear the $3,280 resistance, it could start a downside correction. Initial support on the downside is near the $3,200 level. The first major support is near the $3,180 zone and the trend line. The main support is near the $3,120 level. A clear move below the $3,120 support might increase selling pressure and send the price toward $3,030. Any more losses might send the price toward the $2,850 level in the near term. Technical Indicators Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone. Hourly RSI – The RSI for ETH/USD is now above the 50 level. Major Support Level – $3,120 Major Resistance Level – $3,280

Philippines Securities Regulator Requests Apple and Google to Remove Binance Apps

The Securities and Exchange Commission (SEC) of the Philippines has requested that tech giants Apple and Google remove Binance apps from their respective app stores. The SEC chairman stated that the blockade on Binance, coupled with the removal of its app, curbs the further spread of its unlawful activities in the country. Binance Apps Pose […]

The Securities and Exchange Commission (SEC) of the Philippines has requested that tech giants Apple and Google remove Binance apps from their respective app stores. The SEC chairman stated that the blockade on Binance, coupled with the removal of its app, curbs the further spread of its unlawful activities in the country. Binance Apps Pose […]Bitcoin Price Eyes Next Breakout As The Bulls Aim For $70K

Bitcoin price climbed above the $66,000 resistance zone and started consolidation. BTC is now eyeing the next move above the $67,200 resistance zone. Bitcoin is eyeing a decent increase above the $67,200 resistance zone. The price is trading above $65,500 and the 100 hourly Simple moving average. There is a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair (data feed from Kraken). The pair could gain bullish momentum if it clears the $67,200 resistance zone. Bitcoin Price Eyes More Upsides Bitcoin price started a fresh increase above the $65,500 and $66,000 resistance levels. BTC even climbed above the $67,000 level. It traded as high as $67,200 and is currently consolidating gains. There was a minor decline below the $66,500 level, but the price remained stable above the 23.6% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low. Bitcoin price is still trading above $65,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $65,900 on the hourly chart of the BTC/USD pair. The trend line is near the 50% Fib retracement level of the upward move from the $64,280 swing low to the $67,200 low. Immediate resistance is near the $67,000 level. The first major resistance could be $67,200. A clear move above the $67,200 resistance might send the price higher. The next resistance now sits at $68,500. If there is a clear move above the $68,500 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $70,000. Source: BTCUSD on TradingView.com The next major resistance is near the $70,500 zone. Any more gains might send Bitcoin toward the $72,000 resistance zone in the near term. Are Dips Limited In BTC? If Bitcoin fails to rise above the $67,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $66,200 level. The first major support is $66,000 or the trend line. If there is a close below $66,000, the price could start to drop toward $65,400. Any more losses might send the price toward the $64,200 support zone in the near term. Technical indicators: Hourly MACD – The MACD is now losing pace in the bullish zone. Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level. Major Support Levels – $66,200, followed by $66,000. Major Resistance Levels – $67,000, $67,200, and $68,500.

Cosmos Developers Patch Critical Flaw in IBC Protocol, Safeguarding $126 Million in Assets

Cosmos developers have successfully rectified a critical security vulnerability in its Inter-Blockchain Communication (IBC) protocol, which had placed assets worth at least $126 million in jeopardy, following a private notification from Asymmetric Research. This flaw, existing in the protocol since its 2021 inception, became exploitable recently with the introduction of new codebase developments but was […]

Cosmos developers have successfully rectified a critical security vulnerability in its Inter-Blockchain Communication (IBC) protocol, which had placed assets worth at least $126 million in jeopardy, following a private notification from Asymmetric Research. This flaw, existing in the protocol since its 2021 inception, became exploitable recently with the introduction of new codebase developments but was […]Is A $72K Bitcoin Surge On The Horizon? Glassnode’s Latest Analysis Points To An Answer

Recent insights from Glassnode’s cofounders, shared under their X (formerly Twitter) account ‘Negentrophic’ have sparked interest in Bitcoin market dynamics, leading to a promising stabilization and possible price surge. Related Reading: ‘More Upside Is Coming’: Crypto Market Set For 350% Growth, Predicts Glassnode Cofounders Market Sentiments And EMA Trends With Bitcoin’s value recently wavering below the $70,000 mark, a detailed analysis from the cofounders suggests that a strong support level around the $62,000 50-day Exponential Moving Average (EMA) could set the stage for a significant rebound. This crucial support level indicates a strong buying sentiment, indicating the market’s confidence in the cryptocurrency’s value and a potential resistance against further declines. Using the strategic placement of the 50-day EMA as a support point, the analysis suggests that investors might see the current price levels as a solid base, preventing significant downward movements. #BTC potential trajectory may offer Buy-the-dips Opportunities BTC’s 50-day EMA near $62k provides potential support, targeting $72k for a rebound. Shorter EMAs signal a tendency to buy, while longer EMAs suggest a preference for selling. Given BTC’s recent significant gains… pic.twitter.com/3NjUUqa001 — 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 23, 2024 This perspective is reinforced by recent price movements, where despite a pre-halving general dip, Bitcoin has experienced a 7.1% increase in value over the past week, and the same uptick continued in the last 24 hours. Further analysis by the Glassnode cofounders delves into the behavior of EMAs over different durations. Short-term EMAs indicate a growing inclination among investors to buy, while longer-term EMAs lean towards selling. This contrasting behavior between short and long-term EMAs sheds light on the current phase of the market, which seems to be in a period of consolidation after the notable 92% increase in Bitcoin’s price over six weeks earlier in the year. Such insights are vital as they offer a deeper understanding of the underlying market forces and investor behavior during volatile periods. Meanwhile, Glassnode’s team’s analytical approach extends beyond simple price movements. Yesterday, they compared the current market conditions to the early 2021 “strong correction,” which they term “wave 4” of the ongoing market cycle. This historical perspective provides a lens through which current trends can be evaluated, suggesting a cyclic return to bullish conditions reminiscent of past market behaviors. Bitcoin Bullish Projections And Market Dynamics Bitfinex analysts have highlighted significant activities around Bitcoin withdrawals, supporting the optimistic outlook on Bitcoin. The current levels, echo those of January 2023, suggest that investors are increasingly moving their Bitcoin to cold storage—a sign that many anticipate further price increases. Related Reading: Analyst Reveals Bitcoin’s Bull Market Breakthrough: Here’s What You Need To Know Veering back to Glassnode’s projections yesterday based on their indexes and Fibonacci levels, the cofounders were boldly optimistic, anticipating a potential 350% increase from current market levels. The #Crypto Bull Market Continues. “OTHERS” follows Crypto excl. the largest 10 Cryptos. Observe that we in early 2021 had a strong correction. We believe that was a wave 4. We now have a similar strong decline. More upside is coming. This index and our Fibonacci levels… pic.twitter.com/qKtIOSXneP — 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 22, 2024 Notably, this forecast highlights the expected financial trajectory and underscores a growing confidence among experts and market analysts in Bitcoin’s market performance and its foundational economic principles. Featured image from Unsplash, Chart from TradingView

Bitcoiners Seek Constitutional Reform to Allow Swiss National Bank to Purchase Bitcoin

Yves Bennaïm, founder and chair of 2B4CH, a Swiss pro-Bitcoin think tank, is launching a popular initiative to amend the country’s constitution to allow its central bank to purchase and hold bitcoin. The initiative is also supported by Bitcoin Suisse President Luzius Meisser, who believes the bank should add bitcoin to its reserves. A Reform […]

Yves Bennaïm, founder and chair of 2B4CH, a Swiss pro-Bitcoin think tank, is launching a popular initiative to amend the country’s constitution to allow its central bank to purchase and hold bitcoin. The initiative is also supported by Bitcoin Suisse President Luzius Meisser, who believes the bank should add bitcoin to its reserves. A Reform […]Hedge Funds Fall For The Memecoin Frenzy: “Mind-Boggling” Returns Tempt Financial Giants

In a recent Bloomberg report, it has come to light that the hedge fund industry is increasingly drawn to the allure of the memecoin sector, given the recent price increases and substantial profits that surpass those of Bitcoin (BTC) or the largest altcoins in the market. Related Reading: This Metric Printed In 2017 Before Bitcoin Exploded: Is A Mega Run Incoming? Memecoin Mania One example of the appeal of memecoins to traditional finance institutions is Newport Beach-based Stratos, which launched a liquid fund with the Dogwifhat token in December. The Solana-based memecoin Dogwifhat, known for its mascot – a beanie-wearing dog – became a major player in the crypto world, with its price increasing more than 300 times. This substantial spike reportedly helped Stratos achieve a staggering 137% return in the first quarter of 2024, outperforming gains in the broader crypto market. However, Dogwifhat has since retraced more than 35% from its March 31 all-time high (ATH) of $4.83 and is currently trading at $3.09. Interestingly, Stratos is not alone in venturing into memecoins; other hedge funds are also doing so. Asset manager Brevan Howard, for instance, has reportedly made a “tiny” investment in memecoins. Pantera Capital, a crypto fund, recently emphasized the staying power of memecoins and the “enormous” trading opportunities they present. Is It Just Gambling? Despite the enthusiasm from some hedge funds, the report notes that many crypto participants remain skeptical of memecoins. Quinn Thompson, the founder of Lekker Capital, a hedge fund experimenting with trading memecoins, likened the current frenzy to the speculative fervor seen in traditional markets with stocks like GameStop. In addition, Thompson described memecoins as the “tip of the spear for speculation” and emphasized the “gambling-like” nature of their trading. Still, Cosmo Jiang, a portfolio manager at Pantera Capital, noted the evolution of memecoins beyond mere jokes, calling some “culture coins” that symbolize membership in a particular group or belief system. The report notes that the ease of creating and launching memecoins has increased with the availability of apps like Pump.fun, which allow users to mint coins in minutes. Blockchains like Solana and Coinbase’s Base, which offer low trading fees, have been flooded with these tokens. In light of these developments, Josh de Vos, research lead at CCData, highlighted the improved infrastructure supporting memecoins, including increased liquidity and the development of advanced futures markets on centralized exchanges (CEX). As more hedge funds take memecoins seriously, Rennick Palley of Stratos anticipates a growing focus on these crypto assets. Drawing parallels to the initial skepticism surrounding cryptocurrencies, Palley suggests that meme-only funds may emerge, mirroring the creation of non-fungible token (NFT) funds. Related Reading: XRP Wallets Holding At Least 1 Million Coins Nears All-Time High As Sentiment Improves To further demonstrate the interest and adoption of these emerging tokens, in the first quarter of 2024, memecoins emerged as the most profitable crypto narrative, delivering massive average returns of 1312.6% across its top tokens, according to a recent study conducted by CoinGecko. Currently, the largest memecoin on the market, Dogecoin (DOGE), is trading at $0.1616, up 5% in the last seven days. It has a market cap of $23 billion. Featured image from Shutterstock, chart from TradingView.com

Ripple Asks Court to Reject SEC’s $2 Billion Penalty Request in XRP Case

Ripple Labs has filed its opposition to the request by the U.S. Securities and Exchange Commission (SEC) for the company to pay $2 billion in fines in the XRP case. “The SEC’s draconian remedial requests are ungrounded in law or principle. This court should reject them in their entirety,” Ripple stated. Ripple Files Opposition to […]

Ripple Labs has filed its opposition to the request by the U.S. Securities and Exchange Commission (SEC) for the company to pay $2 billion in fines in the XRP case. “The SEC’s draconian remedial requests are ungrounded in law or principle. This court should reject them in their entirety,” Ripple stated. Ripple Files Opposition to […]Samson Mow On Bitcoin Halving: Brace For Supply Shock, Omega Candle In Sight

Samson Mow, the chief executive at Jan3, recently spoke to Forbes about the latest Bitcoin halving and its potential to catalyze what he refers to as the “Omega candles” – significant price movements that could elevate Bitcoin to the $1 million mark. According to Mow, halvings ensure a controlled distribution of Bitcoin, maintaining scarcity and value. Related Reading: Standard Chartered Reaffirms $150,000 Bitcoin Price Target By Year-End The Mechanics Of Halving And Its Market Implications Samson Mow detailed in the interview with Forbes the mechanics behind Bitcoin halvings—a critical process built into Bitcoin’s framework by its creator, Satoshi Nakamoto. Omega Candle in sight! Omega Candle in sight! The #halving is proof that this system works, but it also means a supply shock is coming for any parties looking to buy large amounts of #Bitcoin. Check out @Excellion‘s comments on the recent halving in this @Forbes article by… pic.twitter.com/xp23ulxQIJ — JAN3 (@JAN3com) April 22, 2024 This mechanism is designed to halve the block rewards given to miners every 210,000 blocks, or approximately every four years, reducing the reward by 50%. So far, the most recent halving has reduced the reward for mining from 6.25 BTC to 3.125 BTC per mined block. However, initially, miners received 50 BTC per block. Still, due to the halvings, this amount has decreased over time to manage inflation and extend the mining lifecycle of Bitcoin’s capped supply of 21 million coins. If not for these halvings, the total supply of Bitcoin would have already been mined. In the same discussion, Mow highlighted the significant impact of newly approved spot-based Bitcoin ETFs, which received SEC approval earlier this year. He believes these ETFs, combined with the reduced block rewards from the halving, could precipitate a “supply shock” in the BTC market. Mow further speculated on the occurrence of what he calls “Omega candles”—large price movement events in the Bitcoin market. He noted that even before the recent halving, the daily demand for Bitcoin was significantly outstripping supply, predicting these Omega candles as almost certain events due to their high volatility and substantial price changes. Mow views these developments as marking the beginning of a new era for Bitcoin, coinciding with its next, or fifth, halving in the coming four years. Bitcoin Bright Future And Market Performance Regarding positive sentiment on Bitcoin, Geoff Kendrick of Standard Chartered also supports this bullish outlook, projecting substantial inflows into BTC akin to those experienced by gold with the advent of gold ETFs. Kendrick suggests that the maturation of the spot ETF market could channel between $50 and $100 billion into BTC. However, despite the post-halving price not reaching the anticipated heights, BTC has demonstrated resilience and potential for considerable growth. Meanwhile, analysts remain confident, predicting significant long-term value increases. For instance, Michael Sullivan’s analysis suggests a possible reach of $245,000 by 2029 if BTC maintains a 30% compound annual growth rate, underlining the optimistic projections shared by several market experts. Related Reading: Bitcoin Price Extends Increase, Why Dips Turned Attractive In Short-Term This optimism is further supported by recent trends, including a 7.1% increase in Bitcoin’s price over the last week, which indicates a possible recovery on the horizon. Featured image from Unsplash, Chart from TradingView

FLOKI And BONK Drop 5% After Revolut Listing Announcement

FLOKI and BONK had remarkable growth over the weekend after recovering from the Bitcoin dip at the end of last week. These tokens have been some of the hottest topics during this bull run, with FLOKI and BONK increasing by over 500% and 87%, respectively. Recently, both memecoins were listed on the European neo bank and retail platform Revolut, but the news didn’t appear to have a massive impact on the tokens. However, the projects’ most recent announcements have seemingly made them soar in the past hour. Related Reading: Solana Meme Coin Massacre: 12 Projects Gone In 30 Days, $27 Million Vanished FLOKI And BONK To Take Over Europe The projects announced their listing on Revolut on Monday. The new listing expands the reach of FLOKI and BONK to a broader audience, as the platform is available to 40 million users in over 150 countries. #FLOKI just got listed on Revolut, the biggest neobank and retail trading app in Europe! This listing will make $FLOKI accessible to @RevolutApp’s 40 million+ users in 150+ countries who will be able to buy FLOKI with 25+ fiat currencies including GBP, EUR, USD and more. Users… pic.twitter.com/Hy62VJw2w4 — FLOKI (@RealFlokiInu) April 22, 2024 Moreover, the listing will allow users to buy the tokens with 25 fiat currencies, including EUR, GBP, and USD, directly from the Revolut app. Per the BONK X post, users in Europe and eligible countries will also have access to a Learn and Earn program starting on April 29. Crypto trader Altcoin Gordon weighed in on the matter, telling his 458,000 followers that the listing was “pretty BIG.” According to Gordon, it will allow the tokens to compete with Dogecoin (DOGE), Dogwifhat (WIF), PEPE, and Shiba Inu (SHIB). Despite the announcement, the tokens performed modestly after the news. FLOKI’s price increased 2% in the following hour, trading at $0.0001778. Nonetheless, the token dropped 5.3% hours later to trade at $0.0001693. Meanwhile, Bonk’s price increased by 3.7%, trading at $0.0002069 before facing a 3.4% dip to the $0.0001990 level. Similarly, both tokens have seen a decrease in daily activity in the past 24 hours. FLOKI’s daily trading volume fell a staggering 31.6%, while BONK’s trading volume dropped over 51%. New Announcements Boost Prices On Tuesday morning, FLOKI was trading at $0.0001727, representing a modest 0.4% gain from the token’s price 24 hours prior. On the other hand, BONK traded for $0.00002019, a 2.6% price decrease from the day before. However, the project’s most recent announcements have positively impacted the tokens’ prices. FLOKI announced that the decentralized platform Alltoscan locked $18 million worth of $ATS for 15 months using the project’s crypto locker protocol, FlokiFi Locker. Alltoscan has just secured over $18,000,000 worth of $ATS tokens for a 15-month period using #Floki’s advanced crypto locker protocol, #FlokiFi Locker!@alltoscan is developing an open-source block explorer compatible with all rollups, enabling users to inspect their L2… https://t.co/RBc0nGnrJr — FLOKI (@RealFlokiInu) April 23, 2024 The news appears to have been well-received by the community. Seemingly fueled by the positive sentiment, the token rose 5.5% in the last hour. Similarly, FLOKI now surged 11.2% from 24 hours ago. Meanwhile, BONK announced renowned artist JT Liss as “The Dog’s Director for BONK Art Masters.” JT is set to lead Bonk’s BAM residency program and the Creator Grants program “to help provide more opportunities for artists in the Solana ecosystem.” Following this news, the token increased by 4.3% in an hour and over 5.6% from its price 24 hours ago. At the time of writing, BONK is trading at $0.00002164. Related Reading: Bitcoin Price Extends Increase, Why Dips Turned Attractive In Short-Term FLOKI is trading at $0.0001921 in the weekly chart. Source: FLOKIUSDT on TradingView Featured Image from Unsplash.com, Chart from TradingView.com

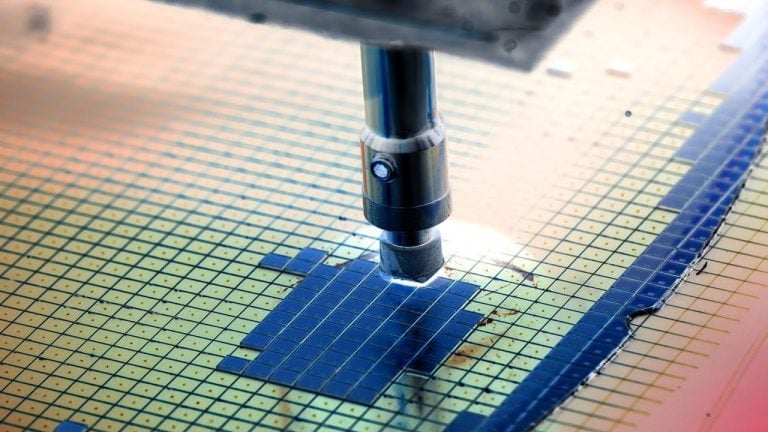

Jack Dorsey’s Block Targets Chip Advancement With 3nm Bitcoin ASIC Mining Rig

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]XRP Surges 12% As Bulls Take Charge, Expert Raises Target To $1.4

XRP has shown notable signs of renewed bullish momentum in the market. It bounced back from a significant 11% price drop on April 12th, which took the token to its lowest level of the year at $0.4230. However, last week saw a solid 12% price recovery, with XRP outperforming the other top 10 altcoins in the market, behind only Solana (SOL) and Binance Coin (BNB). Signs Of A Strong Bullish Trend Ahead For XRP? On Tuesday, XRP hit a high of $0.5571, demonstrating its bullishness and outperforming its peers. This resurgence was paired with a spike in wallet activity, a positive sign for the token’s overall market sentiment. According to the network intelligence platform Santiment, the number of wallets holding at least 1 million XRP has steadily increased over the past six weeks, rising by 3.1%. It is now just one wallet away from reaching an all-time high (ATH). Related Reading: Standard Chartered Reaffirms $150,000 Bitcoin Price Target By Year-End In addition, crypto analyst Ali Martinez reported a notable buying spree among XRP whales, who purchased over 31 million tokens in the past week alone. This has contributed to the cryptocurrency’s price recovery, emphasizing renewed confidence in its uptrend prospects. Regarding price action, market analyst Egrag Crypto points out that XRP has formed a double bottom pattern, considered a strong bullish signal. This pattern, combined with the transition of the consolidation zone into a supply zone and the wicking area into a demand and accumulation zone, indicates a promising outlook for the token, according to the analyst. Egrag Crypto is confident that a significant price spike or “thrust” is imminent, and the analyst has updated his target to $1.4 for XRP. Critical Resistance Levels To Watch Despite initial bullish outlooks for XRP, the token has retraced to the $0.5474 price level as of the time of writing, accompanied by a 14% decrease in market capitalization over the past 30 days. Moreover, as XRP aims to reach higher levels, potential resistance barriers may impede the token’s recovery and the bullish trend. Analyzing the XRP/USD chart below reveals the immediate resistance at $0.5644, which has prevented consolidation above current levels for the past week. Related Reading: The Cardano $1 Dream: Is A Price Explosion Coming Or Just Deja Vu? After that, the final obstacle before a retest of the $0.600 zone lies at the $0.5884 level. This level previously served as a support floor for the token, leading to a rebound during the uptrend seen in March, which took XRP to its yearly high of $0.745. Conversely, monitoring the support levels at $0.52910, $0.5184, and $0.5044 is crucial. If a bearish scenario develops in the coming days, these levels may prevent XRP from falling below $0.500. Featured image from Shutterstock, chart from TradingView.com

SEC Lawyers Resign After Judge Sanctions the Regulator for ‘Gross Abuse of Power’

Two lead attorneys for the U.S. Securities and Exchange Commission (SEC) in the case against crypto firm Debt Box have reportedly resigned. This followed a federal judge sanctioning the SEC for its “gross abuse of power” after the agency made “materially false and misleading representations” in its lawsuit against the cryptocurrency firm. Lead Attorneys in […]

Two lead attorneys for the U.S. Securities and Exchange Commission (SEC) in the case against crypto firm Debt Box have reportedly resigned. This followed a federal judge sanctioning the SEC for its “gross abuse of power” after the agency made “materially false and misleading representations” in its lawsuit against the cryptocurrency firm. Lead Attorneys in […]Analyst Says XRP Price Will Reach $100, But This Needs To Happen First

Crypto analyst JackTheRippler has raised the possibility of the XRP price rising to $100 soon enough. As part of his prediction, he mentioned what needs to happen for the crypto token to attain such ambitious heights. How XRP Price Could Rise To $100 JackTheRippler suggested in an X(formerly Twitter) post that the XRP price hitting $100 was “inevitable” once the case between the Securities and Exchange Commission (SEC) and Ripple came to an end. Furthermore, he predicted that XRP could rise to as high as $10,000, claiming that the crypto token hitting five figures was achievable after the lawsuit. Related Reading: Brazil Wants BTC: 7,400 Bitcoin Futures Contracts Created On First Day Of Trading The analyst’s remarks again highlight the belief among members of the XRP community that the SEC’s lawsuit against Ripple has greatly hindered XRP’s growth. Specifically, the lawsuit is believed to be why XRP underperformed in the 2021 bull run, having made remarkable strides in the 2017 bull run (long before the lawsuit was instituted). Meanwhile, in his remarks, JackTheRippler alluded to XRP gaining regulatory clarity once the case between the SEC and Ripple was over. This statement caught the attention of some of his followers, who pointed out that it had gotten clarity following Judge Analisa Torres’ ruling that XRP isn’t a security. Interestingly, XRP has failed to mount any significant run despite gaining this clarity last year. This is one reason why some XRP holders seem to have lost faith in the crypto token, as expectations were high following Judge Torres’ ruling. However, nothing much happened as the crypto token briefly rose on the back of the ruling but steadily declined in the following weeks. Therefore, these holders will likely be cautious about getting their hopes high despite JackTheRippler’s optimism since XRP could still maintain its unimpressive price action even after the SEC’s lawsuit is over. The SEC’s Lawsuit May Not Be Ending Anytime Soon Meanwhile, it is worth noting that the case between the SEC and Ripple could even drag on beyond this year, irrespective of the outcome of the penalties stage, as both parties are likely to appeal certain rulings. This means that XRP holders might have to wait a while to see if the crypto token hits $100 based on JackTheRippler’s prediction. Related Reading: Shiba Inu Whales Move Over 3.19 Trillion SHIB, Where Are They Headed? If the case is prolonged beyond this year, XRP could miss out on achieving its true potential in this bull run if the lawsuit is indeed acting as a stumbling block to its progress. The lawsuit has, however, not stopped crypto analysts like Egrag Crypto from making bullish predictions for XRP in this bull run. He predicts the crypto token could rise to as high as $27 at this market peak. At the time of writing, XRP is trading at around $0.54, up over 2% in the last 24 hours, according to data from CoinMarketCap. XRP price shows bullish momentum | Source: XRPUSDT on Tradingview.com Featured image from Bitcoinist, chart from Tradingview.com