All the best recent cryptocurrency news, one single place!

Samson Mow On Bitcoin Halving: Brace For Supply Shock, Omega Candle In Sight

FLOKI And BONK Drop 5% After Revolut Listing Announcement

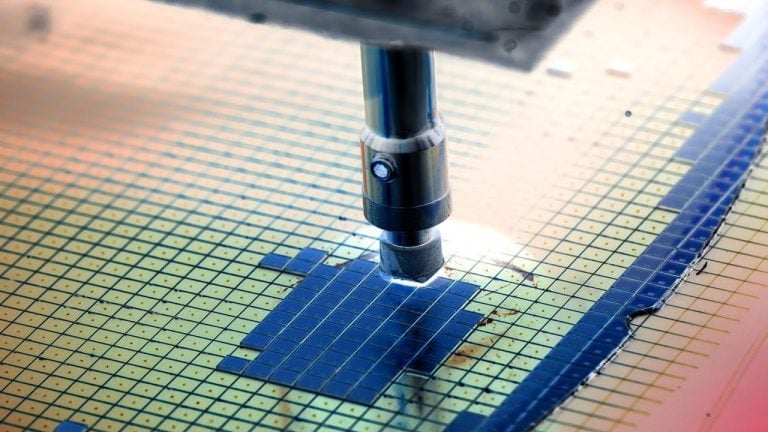

Jack Dorsey’s Block Targets Chip Advancement With 3nm Bitcoin ASIC Mining Rig

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]

On Tuesday, Jack Dorsey, the founder of Block, took to X to announce that the company is “building a mining rig.” Dorsey also shared a blog post authored by Block’s lead for mining hardware products, Naoise Irwin. The post revealed enhancements in the chip design, upgrading from the initially planned 5-nanometer (nm) process to an […]XRP Surges 12% As Bulls Take Charge, Expert Raises Target To $1.4

SEC Lawyers Resign After Judge Sanctions the Regulator for ‘Gross Abuse of Power’

Two lead attorneys for the U.S. Securities and Exchange Commission (SEC) in the case against crypto firm Debt Box have reportedly resigned. This followed a federal judge sanctioning the SEC for its “gross abuse of power” after the agency made “materially false and misleading representations” in its lawsuit against the cryptocurrency firm. Lead Attorneys in […]

Two lead attorneys for the U.S. Securities and Exchange Commission (SEC) in the case against crypto firm Debt Box have reportedly resigned. This followed a federal judge sanctioning the SEC for its “gross abuse of power” after the agency made “materially false and misleading representations” in its lawsuit against the cryptocurrency firm. Lead Attorneys in […]Analyst Says XRP Price Will Reach $100, But This Needs To Happen First

Venezuelan State Oil Company to Accelerate USDT Adoption for Settlements; Tether Vows to Uphold OFAC Sanctions

PDVSA, the state-owned Venezuelan oil company, would be preparing to migrate more of its payments portfolio to USDT, a dollar stablecoin, to avoid being affected by the restitution of U.S. sanctions. Reuters reported that the company started receiving payments in USDT last year and will accelerate its adoption. Tether, nonetheless, stated it will uphold OFAC […]

PDVSA, the state-owned Venezuelan oil company, would be preparing to migrate more of its payments portfolio to USDT, a dollar stablecoin, to avoid being affected by the restitution of U.S. sanctions. Reuters reported that the company started receiving payments in USDT last year and will accelerate its adoption. Tether, nonetheless, stated it will uphold OFAC […]This Metric Printed In 2017 Before Bitcoin Exploded: Is A Mega Run Incoming?

Controversy Swirls Around Bitcoin’s BIP-420: Push Behind Opcode ‘Isn’t in Good Faith,’ Says Developer

On Monday evening, Taproot Wizards co-founder Udi Wertheimer unveiled a Bitcoin Improvement Proposal (BIP) that reintroduces the OP_CAT opcode to Bitcoin. This opcode could facilitate more streamlined and efficient decentralized file hosting systems, payment channels, and sophisticated Bitcoin smart contracts by minimizing reliance on intricate cryptographic techniques. However, Bitcoin developer Luke Dashjr has labeled the […]

On Monday evening, Taproot Wizards co-founder Udi Wertheimer unveiled a Bitcoin Improvement Proposal (BIP) that reintroduces the OP_CAT opcode to Bitcoin. This opcode could facilitate more streamlined and efficient decentralized file hosting systems, payment channels, and sophisticated Bitcoin smart contracts by minimizing reliance on intricate cryptographic techniques. However, Bitcoin developer Luke Dashjr has labeled the […]Is The Bitcoin Top Already Here? This Historical Pattern Says So

Fidelity Digital Assets ‘Signals’ Report Revises Bitcoin Outlook to ‘Neutral’

The latest quarterly report from Fidelity Digital Assets (FDA) Research reveals key insights into the bitcoin and ethereum markets as of Q1 2024. With a detailed analysis of market conditions and future outlooks, FDA’s research report provides several predictions for short and long-term trends. Fidelity Digital Assets Spotlights Bitcoin and Ethereum Market Shifts in New […]

The latest quarterly report from Fidelity Digital Assets (FDA) Research reveals key insights into the bitcoin and ethereum markets as of Q1 2024. With a detailed analysis of market conditions and future outlooks, FDA’s research report provides several predictions for short and long-term trends. Fidelity Digital Assets Spotlights Bitcoin and Ethereum Market Shifts in New […]XRP Wallets Holding At Least 1 Million Coins Nears All-Time High As Sentiment Improves

Blackrock Bitcoin ETF Sees 70 Straight Days of Inflows — Holdings Near 274K BTC

The world’s largest asset manager with $10.5 trillion in assets under management, Blackrock, has seen 70 consecutive days of inflows into its spot bitcoin exchange-traded fund (ETF). This achievement places Ishares Bitcoin Trust (IBIT), which has amassed approximately 274K bitcoins since its launch, among the top 10 ETFs with the longest daily inflow streaks. IBIT: […]

The world’s largest asset manager with $10.5 trillion in assets under management, Blackrock, has seen 70 consecutive days of inflows into its spot bitcoin exchange-traded fund (ETF). This achievement places Ishares Bitcoin Trust (IBIT), which has amassed approximately 274K bitcoins since its launch, among the top 10 ETFs with the longest daily inflow streaks. IBIT: […]The Cardano $1 Dream: Is A Price Explosion Coming Or Just Deja Vu?

Crypto.com Delays App Launch in South Korea over Regulatory Scrutiny

Crypto.com has postponed the planned launch of its app in

South Korea due to scrutiny by the regulators on the exchange’s anti-money laundering

practices. According to a local media publication Segye Ilbo, Korean financial

authorities have initiated an emergency on-site inspection of the crypto exchange.

Anti-Money Laundering Concerns

The inspection, conducted by the Financial

Intelligence Unit under the Financial Services Commission, followed the

discovery of anti-money laundering-related issues in the data submitted by

Crypto.com.

Crypto.com has emphasized its commitment to

maintaining proper anti-money laundering standards, according to a report by

Coindesk. The firm mentioned that it adheres to the “highest”

standards. However, it intends to postpone the launch of the new service to

ensure that Korean regulators are fully apprised of its policies, procedures,

systems, and controls.

The exchange had announced plans to launch a local

mobile application facilitating coin trading next week. According to the firm,

the service promises competitive pricing and support for various virtual asset

transactions. Crypto.com obtained approvals to operate in South

Korea in 2022. However, regulatory hurdles have proved challenging for

the crypto exchange.

Early this month, Crypto.com announced the decision to debut the new app in South Korea, describing it as a specialized trading platform specifically designed for the Korean market. Commenting about the launch, Eric Anziani, the Chief

Operating Officer of Crypto.com, highlighted Korea’s tech-savvy population and

its adoption of innovation as key factors driving this decision.

Anziani mentioned: “The first product we will be launching in Korea is the

crypto.com app, which is our most popular product globally. It’s a fully mobile

product offering a convenient and safe way to buy, sell, and store digital

assets, including non-fungible tokens, enabling Korean customers to access

global prices in a regulated manner.”

Navigating Korean Crypto Regulations

Moreover, the company aims to support Korean creators

and artists through potential partnerships, leveraging the country’s influence as a

cultural powerhouse. With ongoing discussions with local banks, Crypto.com plans to establish partnerships for account authentication, a regulatory requirement

in Korea.

Presently, the Korean cryptocurrency market has five

won-based exchanges authorized by financial authorities. By entering this

market, Crypto.com will offer users an alternative trading platform while

fostering competition and innovation in the local cryptocurrency sector.

This article was written by Jared Kirui at www.financemagnates.com.