All the best recent cryptocurrency news, one single place!

FTX plans full pay back of all creditors ‘plus billions in compensation’

Under the plan, 98% of FTX creditors will get at least 118% of their claims back — the remainder will receive all of their claims “plus billions in compensation,” says FTX.

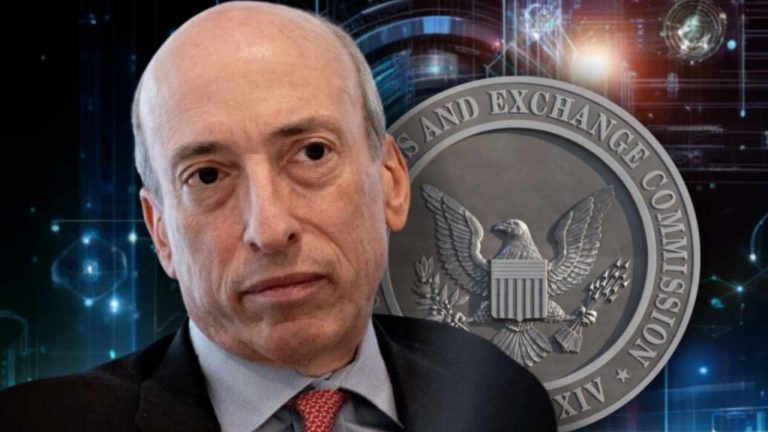

SEC Chair Gary Gensler Calls Crypto ‘Outsized Piece of Scams, Frauds, and Problems in Our Markets’

The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has reiterated his view that crypto is a field full of noncompliance. While noting that crypto is a small piece of the overall U.S. financial market that his agency oversees, the SEC chair emphasized that it is “an outsized piece of the scams […]

The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has reiterated his view that crypto is a field full of noncompliance. While noting that crypto is a small piece of the overall U.S. financial market that his agency oversees, the SEC chair emphasized that it is “an outsized piece of the scams […]Dogecoin on the Rise: Over 5 Million Wallets Now Profitable As Potential Surge Looms

Robinhood Prepares to Fight SEC in Court Over Crypto, CEO Reveals

Robinhood Markets is preparing to fight the U.S. Securities and Exchange Commission (SEC) in court to defend its crypto business and establish “regulatory clarity in the United States for the benefit of our customers,” CEO Vlad Tenev said after his company received a Wells notice from the securities regulator. “The SEC’s continued attack on crypto, […]

Robinhood Markets is preparing to fight the U.S. Securities and Exchange Commission (SEC) in court to defend its crypto business and establish “regulatory clarity in the United States for the benefit of our customers,” CEO Vlad Tenev said after his company received a Wells notice from the securities regulator. “The SEC’s continued attack on crypto, […]Grayscale withdraws its Ethereum Futures ETF application

The withdrawal comes a little over two weeks before the United States securities regulator will be forced to make a decision on at least one spot Ether ETF application.

AI Tokens ‘Preparing For Round 2’: Industry Shows 8% Growth With RNDR And FET

Ex-Digitex Futures Exchange CEO pleads guilty to violating Bank Secrecy Act

U.S. authorities indicted former Digitex CEO Adam Todd in February for failure to implement and maintain an effective Anti-Money Laundering program at the exchange.

Philosopher Yuval Noah Harari warns of AI’s risks in finance

The bestselling author, philosopher and historian sees grim potential for AI to get out of control in the financial system.

2 Bitcoin L2 Projects Secure Investments to Enhance Bitcoin’s Defi Capabilities

On Tuesday, two Bitcoin-centric layer two (L2) initiatives successfully secured funding from strategic investors. Botanix Labs, a startup focused on developing a decentralized Turing-complete L2 EVM (Ethereum Virtual Machine), garnered $11.5 million. Meanwhile, the Bitcoin L2 ZKM attracted $5 million during a pre-seed investment phase. Bitcoin L2 Projects Gain Momentum With New Financing Rounds Throughout […]

On Tuesday, two Bitcoin-centric layer two (L2) initiatives successfully secured funding from strategic investors. Botanix Labs, a startup focused on developing a decentralized Turing-complete L2 EVM (Ethereum Virtual Machine), garnered $11.5 million. Meanwhile, the Bitcoin L2 ZKM attracted $5 million during a pre-seed investment phase. Bitcoin L2 Projects Gain Momentum With New Financing Rounds Throughout […]Susquehanna International Group adds $1B in Bitcoin ETFs to portfolio

According to a filing with the U.S. SEC, Susquehanna International Group invested more than $1 billion in Bitcoin ETFs in Q1 2024.

Can Ethereum Reclaim $4,000? Fragile Fundamentals Threaten To Send ETH Crashing

‘Big Short’ Investor Calls Crypto One of the ‘Great Themes of Our Time,’ But He’s Not a Believer

In a recent interview on Bloomberg Television, Steve Eisman of Neuberger Berman, who gained prominence from “The Big Short,” shared insights on the impending U.S. election and his investment strategies. Eisman identified three significant current themes, including cryptocurrency, about which he expressed skepticism. Steve Eisman’s Take: Trump’s Re-Election and the So-Called Crypto Conundrum Steve Eisman, […]

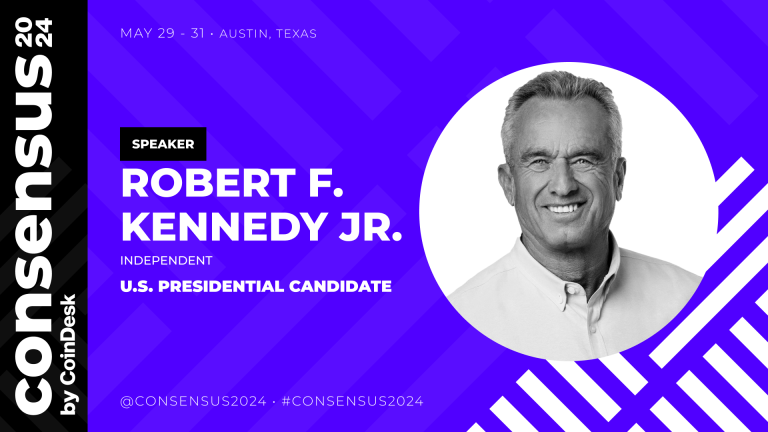

In a recent interview on Bloomberg Television, Steve Eisman of Neuberger Berman, who gained prominence from “The Big Short,” shared insights on the impending U.S. election and his investment strategies. Eisman identified three significant current themes, including cryptocurrency, about which he expressed skepticism. Steve Eisman’s Take: Trump’s Re-Election and the So-Called Crypto Conundrum Steve Eisman, […]Independent Presidential Candidate Robert F. Kennedy Jr. Joins Consensus as a Headline Speaker

PRESS RELEASE. May 7, 2024, Austin, TX – In less than four weeks, independent presidential candidate Robert F. Kennedy Jr. will take the stage in Austin, TX, at Consensus 2024, the world’s largest, longest-running, and most influential gathering that brings together all sides of the crypto and Web3 community. As an environmental lawyer, scion of […]

PRESS RELEASE. May 7, 2024, Austin, TX – In less than four weeks, independent presidential candidate Robert F. Kennedy Jr. will take the stage in Austin, TX, at Consensus 2024, the world’s largest, longest-running, and most influential gathering that brings together all sides of the crypto and Web3 community. As an environmental lawyer, scion of […]